Tax Return Job Expenses . To claim for actual business expenses or to declare income. Claim wfh and other allowable employment expenses not reimbursed by your employer. How to claim employment expenses in your 2024 tax return. Employment expenses are recovered by entering them into the employment. If you have changes to make, you can amend your income, deduction and reliefs (e.g. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax.

from www.formsbank.com

Employment expenses are recovered by entering them into the employment. To claim for actual business expenses or to declare income. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. Claim wfh and other allowable employment expenses not reimbursed by your employer. If you have changes to make, you can amend your income, deduction and reliefs (e.g. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. How to claim employment expenses in your 2024 tax return.

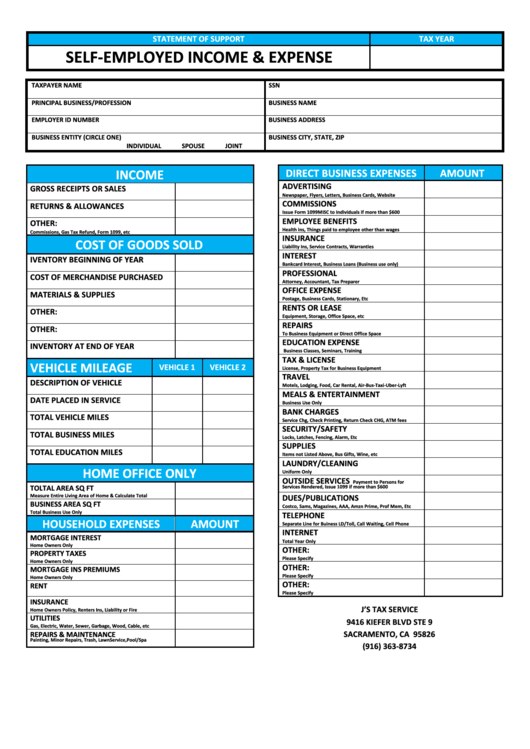

SelfEmployed & Expense printable pdf download

Tax Return Job Expenses If you have changes to make, you can amend your income, deduction and reliefs (e.g. Claim wfh and other allowable employment expenses not reimbursed by your employer. How to claim employment expenses in your 2024 tax return. To claim for actual business expenses or to declare income. If you have changes to make, you can amend your income, deduction and reliefs (e.g. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. Employment expenses are recovered by entering them into the employment. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning.

From lesboucans.com

Tax Return Expenses Template For Your Needs Tax Return Job Expenses Employment expenses are recovered by entering them into the employment. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. To claim for actual business expenses or to declare income. Claim wfh and other allowable employment expenses not reimbursed. Tax Return Job Expenses.

From tax29.com

Resources Tax Return Job Expenses Claim wfh and other allowable employment expenses not reimbursed by your employer. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. If you have changes to make, you can amend your income, deduction and reliefs (e.g. Earlier this month, the inland revenue authority of singapore (iras) has announced. Tax Return Job Expenses.

From db-excel.com

Business Expenses Spreadsheet For Taxes — Tax Return Job Expenses Claim wfh and other allowable employment expenses not reimbursed by your employer. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. If you have changes to make, you can amend your income, deduction and reliefs (e.g. To claim. Tax Return Job Expenses.

From www.template.net

Tax Expenses Template Excel, Google Sheets Tax Return Job Expenses Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. To claim for actual business expenses or to declare income. Claim wfh and other allowable employment expenses not reimbursed by your employer. Employment expenses are recovered by entering them into the employment. If you have changes to make, you can amend your income, deduction and reliefs. Tax Return Job Expenses.

From staycanada.info

Tax Return Should I claim 400 or 3,000 for Home Office Expenses for Tax Return Job Expenses If you have changes to make, you can amend your income, deduction and reliefs (e.g. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claim wfh and other allowable employment expenses not reimbursed by your employer. To claim for actual business expenses or to declare income. How to claim employment expenses in your 2024 tax. Tax Return Job Expenses.

From db-excel.com

Australian Tax Return Spreadsheet Template Spreadsheet Downloa Tax Tax Return Job Expenses Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claim wfh and other allowable employment expenses not reimbursed by your employer. To claim for actual business expenses or to declare income. Employment expenses are recovered by entering them. Tax Return Job Expenses.

From www.scribd.com

Tax Return PDF Expense Taxes Tax Return Job Expenses Employment expenses are recovered by entering them into the employment. To claim for actual business expenses or to declare income. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. If you have changes to make, you can amend your income, deduction and reliefs (e.g. Earlier this month, the inland revenue authority of singapore (iras) has. Tax Return Job Expenses.

From www.pinterest.com

Expense Report Spreadsheet Template Excel (3) PROFESSIONAL TEMPLATES Tax Return Job Expenses Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. Claim wfh and other allowable employment expenses not reimbursed by your employer. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals. Tax Return Job Expenses.

From lesboucans.com

Tax Return Expenses Template For Your Needs Tax Return Job Expenses Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. Employment expenses are recovered by entering them into the employment. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claim wfh and other allowable employment expenses not reimbursed by your employer. How to claim employment expenses in your. Tax Return Job Expenses.

From old.sermitsiaq.ag

1099 Expense Report Template Tax Return Job Expenses Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claim wfh and other allowable employment expenses not reimbursed by your employer. How to claim employment expenses in your 2024 tax return. If you have changes to make, you can amend your income, deduction and reliefs (e.g. Earlier this month, the inland revenue authority of singapore. Tax Return Job Expenses.

From www.youtube.com

How to Claim work related expenses make deductions in tax Tax Return Job Expenses Claim wfh and other allowable employment expenses not reimbursed by your employer. Employment expenses are recovered by entering them into the employment. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. How to claim. Tax Return Job Expenses.

From www.formsbirds.com

Self Employment Form 2 Free Templates in PDF, Word, Excel Download Tax Return Job Expenses Employment expenses are recovered by entering them into the employment. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. How to claim employment expenses in your 2024 tax return. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. To claim for actual business. Tax Return Job Expenses.

From www.alamy.com

Educator expenses deduction on form for federal tax return and Tax Return Job Expenses Claim wfh and other allowable employment expenses not reimbursed by your employer. If you have changes to make, you can amend your income, deduction and reliefs (e.g. To claim for actual business expenses or to declare income. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. How to. Tax Return Job Expenses.

From biznessprofessionals.com

What is a Tax Deduction? Definition, Examples, Calculation Tax Return Job Expenses If you have changes to make, you can amend your income, deduction and reliefs (e.g. How to claim employment expenses in your 2024 tax return. Employment expenses are recovered by entering them into the employment. Claim wfh and other allowable employment expenses not reimbursed by your employer. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals. Tax Return Job Expenses.

From db-excel.com

Tax Return Spreadsheet pertaining to Self Employed Expense Sheet Tax Tax Return Job Expenses Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. If you have changes to make, you can amend your income, deduction and reliefs (e.g. To claim for actual business expenses or to declare income. Employment expenses are recovered by entering them into the employment. Generally, you may claim tax deductions on expenses. Tax Return Job Expenses.

From thefinance.sg

A Singaporean’s Guide How to Claim Tax Deduction for Work Tax Return Job Expenses If you have changes to make, you can amend your income, deduction and reliefs (e.g. To claim for actual business expenses or to declare income. Employment expenses are recovered by entering them into the employment. Claiming tax relief on expenses you have to pay for your work, like uniforms, tools, travel and working from home costs. Generally, you may claim. Tax Return Job Expenses.

From db-excel.com

Business Expense Spreadsheet For Taxes — Tax Return Job Expenses How to claim employment expenses in your 2024 tax return. Employment expenses are recovered by entering them into the employment. Claim wfh and other allowable employment expenses not reimbursed by your employer. Generally, you may claim tax deductions on expenses 'wholly and exclusively' incurred in earning. Claiming tax relief on expenses you have to pay for your work, like uniforms,. Tax Return Job Expenses.

From marenbsidoney.pages.dev

Tax Year 2024 Form 2024 Schedule A Dasi Timmie Tax Return Job Expenses Claim wfh and other allowable employment expenses not reimbursed by your employer. To claim for actual business expenses or to declare income. Earlier this month, the inland revenue authority of singapore (iras) has announced individuals may claim certain tax. Employment expenses are recovered by entering them into the employment. Generally, you may claim tax deductions on expenses 'wholly and exclusively'. Tax Return Job Expenses.